Table of Contents6 Simple Techniques For How To Pass Life Insurance Medical ExamWhat Is The Cash Value Of A Life Insurance Policy Can Be Fun For Everyone

Lots of insurance provider offer insurance policy holders the alternative to tailor their (how much is a unit of colonial penn life insurance?).

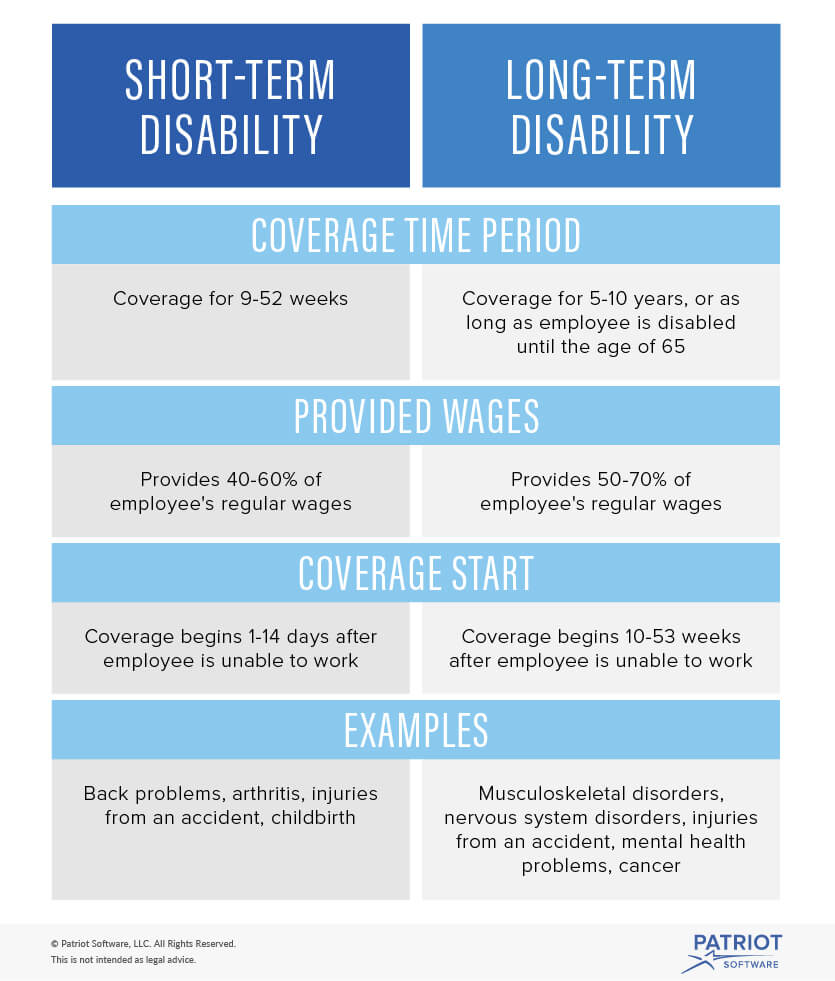

policies to accommodate their requirements. Riders are the most typical way insurance policy holders may modify their strategy. There are numerous riders, but accessibility depends upon Extra resources the supplier. The policyholder will usually pay an additional premium for each rider or a cost to exercise the rider, though some policies include specific riders in their base premium. The waiver of premium rider eases the insurance policy holder of making premium payments if the insured ends up being handicapped and not able to work. The impairment earnings rider pays a regular monthly earnings in case the insurance policy holder ends up being unable to work for several months or longer due to a major illness or injury. The long-lasting care rider is a type of accelerated survivor benefit that can be utilized to pay for retirement home, helped living, or at home care when the insured needs aid with activities of everyday living, such as bathing, consuming, and using the toilet. An ensured insurability rider lets the insurance policy holder buy additional insurance at a later date without a medical evaluation. It's crucial to examine your policy document to comprehend what risks your policy covers, how much it will pay your beneficiaries, and under what circumstances. Prior to you make an application for life insurance, you ought to examine your financial circumstance and identify how much money would be needed to keep your recipients' standard of life or satisfy the need for which you're purchasing a policy. You might investigate the cost to work with a baby-sitter and a housemaid, or to use industrial child care and a cleaning service, then maybe add some cash for education.

Add up what these costs would be over the next 16 or two years, add more for inflation, and that's the survivor benefit you might wish to buyif you can manage it. You might require to upgrade the policy's recipients, increase your protection, or even reduce your protection. Insurance companies examine each life insurance candidate on a case-by-case basis, and with numerous insurance providers to select from, practically anyone can discover an economical policy that a minimum of partially satisfies their needs. In 2018 there were 841 life insurance coverage and annuity companies in the United States, according to the Insurance Details Institute. There are likewise brokers who focus on life insurance and know what various business provide. Applicants can deal with a broker complimentary of charge to discover the insurance they require.

This indicates that nearly anybody can get some kind of life insurance policy if they look hard adequate and are ready to pay a high enough price or accept a maybe less-than-ideal death benefit. the person who receives financial protection from a life insurance plan is called a:. In basic, the younger and healthier you are, the easier it will be to qualify for life insurance, and the older and less healthy you are, the harder it will be. Specific lifestyle choices, such as utilizing tobacco or taking part in risky pastimes such as skydiving, likewise make it harder to certify or result in higher rates. Nevertheless, for wealthy individuals, the tax advantages of life insurance coverage, including tax-deferred development of money worth, tax-free dividends, and tax-free death advantages, can offer extra tactical opportunities. Policies with a money worth or financial investment component can supply a source of retirement earnings. This opportunity can come with high costs and a lower survivor benefit, so it might only be a great option for individuals who have maxed out other tax-advantaged cost savings and investment accounts. The death benefit of a life insurance coverage policy is normally tax totally free. Rich individuals sometimes purchase long-term life insurance within a trust to help pay the estate taxes that will be due upon their death.

This technique helps to protect the value of the estate for their successors. Tax avoidance is an obedient method for lessening one's tax liability and should not be puzzled with tax evasion, which is prohibited. Technically, you are obtaining cash from the insurance coverage business and using your cash worth as security. Unlike with other types of loans, the insurance policy holder's credit report is not a factor. Repayment terms can be flexible, and the loan interest returns into the policyholder's cash worth account. Policy loans can minimize the policy's survivor benefit, however. If you have family who relies on you for financial backing, you need life insurance coverage. Life insurance coverage will pay your loved ones a survivor benefit after you pass away that might be used to keep footing the bill when you're not around. Married people need life insurance coverage even if they do not have any kids. Even if you're not fretted about loan payments, the survivor benefit might help spend for funeral costs, which are substantial , or even just a getaway to eliminate a few of the sting of losing a liked one. If you do have children, they can't be named as a recipient without using a complicated loophole in monetary law. Single individuals may still require life insurance, especially if they're service owners. You want your organisation partner to succeed if you die, so you can call him or her as the recipient.( This is called having an insurable interest. You can't simply name anyone.) Say you're not wed, have no kids, and do not plan on starting a business with anyone whenever soon. But what if those strategies alter? You could require life insurance later in life, but already you might be ineligible due to a medical condition or find that the premiums have actually become unaffordable. Life insurance coverage rates increase with age. Life insurance coverage will cover most causes of death, whether it is because of health the wesley group problem, mishap, or natural causes. That suggests beneficiaries can.

use it for any costs they please: spending for everyday costs, saving for college, staying up to date with a home mortgage, and so on. Discover more about what life insurance covers and what it doesn't. When you buy life insurance, you're essentially buying a death benefit. If you need a greater death advantage, you'll.

Rumored Buzz on Whose Life Is Covered On A Life Insurance Policy That Contains A Payor Benefit Clause?

pay greater premiums. Build up the costs of any current financial obligations you share with your liked ones, such as any trainee loans, co-signed charge card, or home mortgage payments. That's simply the monetary commitment side. You'll also wish to offer your partner a comfy requirement of living after you're gone and offer money for significant expenditures like end-of-life medical costs and funeral costs.

Tuition expenses are higher than ever, and a death benefit can help spend for all or part of the costs if you're not around to keep spending for your kids' education. In addition, any money leftover can be set aside for your kids until http://alexiswzrr647.theglensecret.com/how-much-is-life-insurance-a-month-things-to-know-before-you-buy they're old sufficient to acquire it. If you name your business partner as a recipient, you should consider any impressive organisation loans as well.

as the amount you contribute to grow business.